3 Kegagalan mengemukakan borang nyata pada atau sebelum tarikh akhir pengemukaan. Advisable to do business in personal name2.

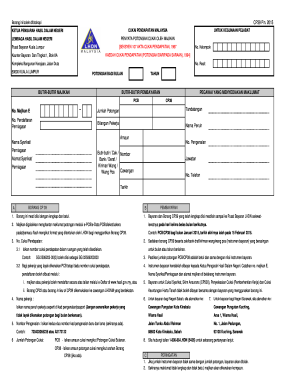

Pcb Tp1 1 2021 New Form Format Otosection

30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

. Total income tax exemptions and reliefs chargeabletaxable income. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. - tarikh akhir borang BE bagi taksiran 2019 adalah 3062020.

Is the Borang B difficult to complete. Paying income tax due accordingly may avoiding you from being charged tax increase court action and. Borang eab prima borang b income tax e filing lhdn cara isi efiling.

I have never use a tax agent before3. As an example lets say your annual taxable income is RM48000. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara.

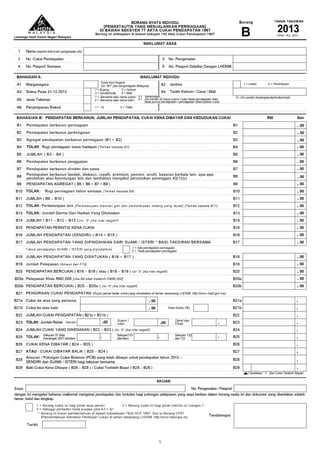

Form B - income assessed under Section 4 a - 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Income tax borang b Borang B 2018 Jaroncxt Borang B 2018 Jaroncxt What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News Buku Panduan Borang B Beza Borang B Dan Borang Be Otosection Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih. Form P Income tax return for partnership Deadline.

BORANGB BAGI PENDAPATAN TAHUN 2003 RETURN OF INCOME BY AN INDIVIDUAL FOR THE YEAR 2003 File No. 1 Tarikh akhir pengemukaan borang dan bayaran cukai atau baki cukai kena dibayar. 30042022 15052022 for e-filing 5.

Remember if youre an employee you have about 7 days left before the income tax deadline of 30 April 2008. Form B Income tax return for individual with business income income other than employment income Deadline. Butang Simpan Cetak Pengesahan Untuk menyimpan dan mencetak slip pengesahan penerimaan borang.

At rate B23b. 30062022 15072022 for e-filing 6. Total rebate - Self.

The income tax relief of RM6000 for a disabled individual is. Total 00rebate - Self. Income tax return for individual who only received employment income Deadline.

Terdapat 3 butang pada skrin ini iaitu -. 00 At rate B21b. Ad Try the UKs fastest and most trusted digital tax advice service.

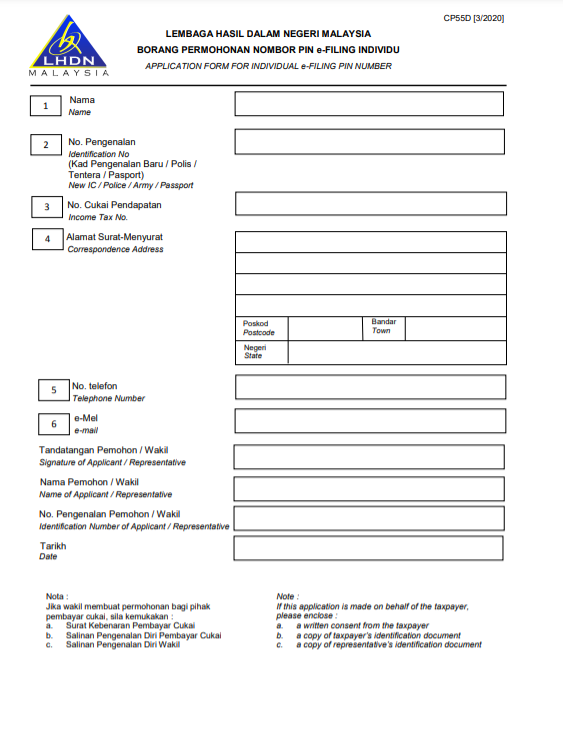

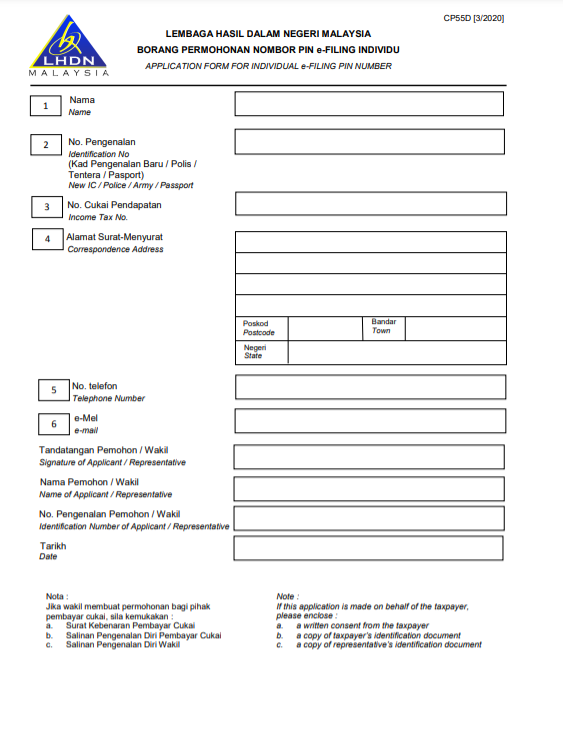

If I register an enterprise I assume I will then need to use Borang B instead. Sila isi Borang CP57 yang boleh diperoleh di Portal Rasmi LHDNM. Borang BE untuk individu yang hanya ada pendapatan penggajian SAHAJA.

What is my tax bracket This professional tax calculator can help you lets click on the calculate button to try it now for FREE. Semua jenis hasil perniagaan perlu diistiharkan dalam borang B. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

Form BE income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. B24 TOTAL INCOME TAX B23a B23b B24. B22 TOTAL INCOME TAX B21a B21b B22.

Pengesahan Penerimaan Borang Cukai Pendapatan Cara Isi Borang e-Filling Online i. Choose your corresponding income tax form ie. Skrin Pengesahan Penerimaan e-BE Bagi Tahun Taksiran XXXX seperti di bawah akan dipaparkan.

00 N Zakat - Departure levy for umrah travel. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Accountant when come to Borang B Borang BE submission a common question may ask from your customers.

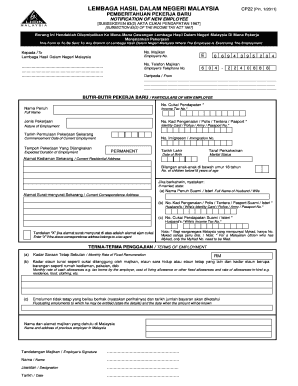

30 Jun 2021 2 Pengemukaan secara e-Filing e-B boleh dibuat melalui httpsmytaxhasilgovmy. LEMBAGA HASIL DALAM NEGERI MALAYSIA Please ensure that your name is printed correctly as it appears in your identity cardpassport. B21 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpwwwhasilgovmy B21a Tax on the first.

Can I declare my business income if I receive a Form BE. B23 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpswwwhasilgovmy B23a Tax on the first. I am considering doing some small business and dont expect much activities in the first year.

B23b 00Tax on the balance. 1 Borang nyata ini bagi pihak saya sendiri 3 Sebagai pentadbir harta pusaka Jika A4 4 2 Borang nyata ini bagi pihak individu di ruangan 1 Pemberitahuan Kematian Pembayar Cukai Borang ini bukan pemberitahuan di bawah subseksyen 743 ACP 1967. I just want tax payable RM 8000 only how much yearly income do I need to report to LHDN.

Form B income assessed under Section 4 a 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership. April 24 2008 by Krista Goon. Borang B adalah borang istihar pendapatan bagi individu yang menjalankan perniagaan.

Ad Try the UKs fastest and most trusted digital tax advice service. If youre a business owner you still have 67 days left your deadline is 30 June 2008. Borang B How to File Your Income Tax the e-Filing way.

I submit my Income Tax Borang BE every year myself. Business income should be declared in the Form B. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Total 00rebate - Self. Pendapatan yang diperolehi adalah dari hasil perniagaan.

Once youve logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form. Book a call today. Goodbye traditional accountants Dean London Verified review.

00-Husband wife. Income other than business. Itulah pembahasan perihal Cara Isi Borang e-Filing Cukai Pendapatan Individu Borang BE B 2020 yang telah admin rangkum berasal dari bermacam sumber.

E filing lhdn malaysia. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. 00 B23 - Departure levy for umrah travel.

Borang B - 18 images - borang b sample borang b atau be bagaimana mengisi borang cukai individu pendapatan pesuruhjaya sumpah shahab perdana borang borang borang kc kategori 1a borang dg44 1 sulit kategori1b borang. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. E-BE if you dont have business income and choose the assessment year tahun taksiran 2015.

Jika kamu belum menemukan Info yang dicari silahkan tulis komentar dan jika artikel ini berfaedah. Book a call today. Goodbye traditional accountants Dean London Verified review.

B21b Tax on the balance.

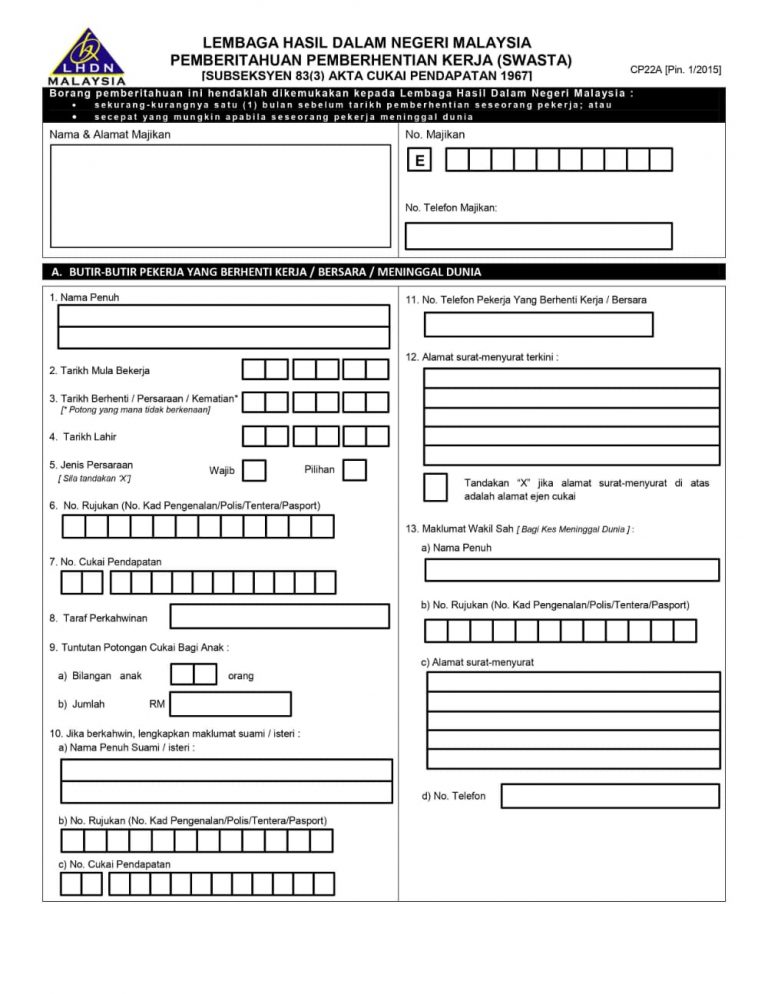

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

It S Income Tax Season Again But Don T Worry Here S A List Of All The Things You Can Claim As A Tax Relief For Ya 2021 Wau Post

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Cp39 Login Fill Out And Sign Printable Pdf Template Signnow

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Cp22 Form 2021 Online Submission Fill Online Printable Fillable Blank Pdffiller

Income Tax Form Ea 4 Why Income Tax Form Ea 4 Had Been So Otosection

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

G G Human Resources Services What Is Form Cp22 Form Cp22 Is A Government Report That Is Issued By The Lhdn Cp22 Is A Notification Of New Employee Form An

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022